SELF CHECK 9.1 : Online Discussion

Once completed view the video. Let's discuss!

Tutorial (9) _Working Capital Management

▪ Details: 5 questions

▪ Duration of submission: 1 week

Question 1 :

ABC, Inc., is considering opening a new convenience store in downtown New York City. The expected annual revenue at the new store is $900,000. To estimate the increase in working capital, analysts estimate the ratio of cash and cash-equivalents to revenue to be 0.03 and the ratios of receivables, inventories, and payables to revenue to be 0.05, 0.10, and 0.04, respectively, in the same industry. What is the incremental cash flow related to working capital when the store is opened?

Question 2 :

Suppose ABC Limited has Current Assets $ 5,00,000 and Current Liabilities of $ 300,000. Fixed Assets are $ 1,00,000. Long Term Debt is $1,00,000 and Short Term Debt included in the Current Liability above is $25,000. Calculate the Working Capital of the Company and analyze the same.

Question 3:

PQR Limited has Current Assets of $2,00,000 and Current Liabilities of $ $90,000. Inventory of $ 1,50,000 included in current Assets have become Obsolete since the Goods are lying in Inventory for more than 6 months. The Market Value of the same would be $50,000.

Question 4 :

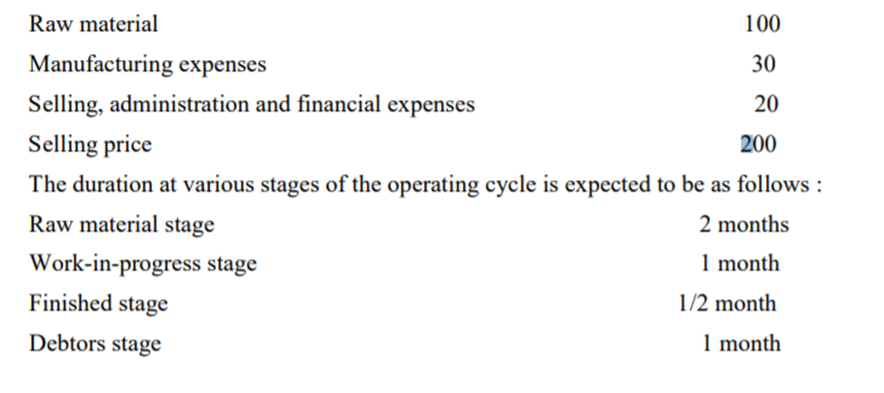

AXN Ltd. plans to sell 30,000 units next year. The expected cost of goods sold is as follows:

($) Per Unit

Assuming the monthly sales level of 2,500 units, estimate the gross working capital requirement. Desired cash balance is 5% of the gross working capital requirement and working- progress in 25% complete with respect to manufacturing expenses.

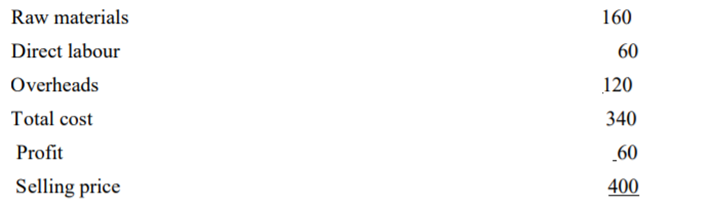

Question 4 :

Calculate the amount of working capital requirement for CDE Ltd. from the following information:

($) Per Unit

Question 5 :

Raw materials are held in stock on an average for one month. Materials are in process on an average for half-a-month. Finished goods are in stock on an average for one month. Credit allowed by suppliers is one month and credit allowed to debtors is two months. Time lag in payment of wages is 1½ weeks. Time lag in payment of overhead expenses is one month. One fourth of the sales are made on cash basis.

Cash in hand and at the bank is expected to be $ 50,000; and expected level of production Cash in hand and at the bank is expected to be $ 50,000; and expected level of production amounts to 1,04,000 units for a year of 52 weeks.

You may assume that production is carried on evenly throughout the year and a period of four weeks is equivalent to a month.