SELF CHECK 5.1 : Online Discussion

Once completed view the video. Let's discuss!

Tutorial (5) _Capital Budgeting calculations.

▪ Details: 2 questions

▪ Duration of submission: 1 week

Question 1:

ABX Company has the following mutually exclusive projects.

|

Year |

Project A Cash Flow (RM) |

Project B Cash Flow (RM) |

|

0 |

650 |

-700 |

|

1 |

100 |

300 |

|

2 |

250 |

-200 |

|

3 |

250 |

550 |

|

4 |

200 |

200 |

|

5 |

100 |

80 |

a. Calculate the payback of Project A.

b. Calculate the discounted payback of Project A at required return of 8 percent.

c. Calculate the IRR of Project A.

d. Calculate the MIRR of project B.

e. Using the NPV method and assuming a cost of capital of 8 percent, which of these projects should

be accepted.

Question 2:

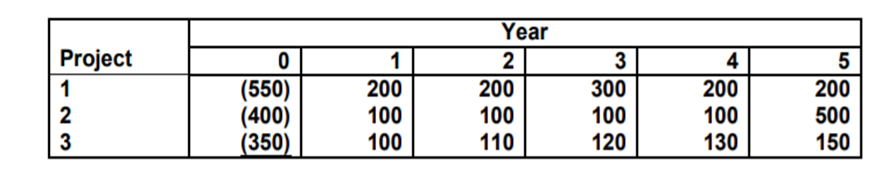

A company is considering three possible capital investment projects, which have the following estimated cash flows (in $000):

a. Rank these projects in order of acceptability using:

i. Payback period.

ii. Net present value using a discount rate of 20%.

b. Assuming the projects are independent and indivisible and that the company has up to $1 million to

invest:

i. Explain which projects should be accepted.

ii. Find the total net present value for the company’s total investment.

c. Calculate profitability indices for all the projects, and show which projects should be accepted, and

what the total net present value will be, if the projects are independent and divisible, and the

company has up to $1 million to invest.

d. Explain the advantages and disadvantages of the appraisal methods used in (a) above.