General

- WELCOME_OBA3105_INTRODUCTION TO FINANCE_BBAIB_ODL

This is Introduction to Finance OBA 3105, a core subject in Bachelor of Business Administration in International Business (BBAIB)_ODL

DESCRIPTION OF THE COURSE

This module is designed to provide students with a strong foundation in finance that allows them to understand and apply the concepts in the world of finance as well as to focus their attention to certain issues they can further explore. which applicable for both in personal and managerial finance. At the end of the course, students can recognize relationship between finance and other business disciplines, as well as to be able to use synergy of those disciplines in decision making.

AIM OF THE COURSEThe overall aim of the module is to give students an exposure to the basic business finance theory both quantitative and qualitative with some simple applications.

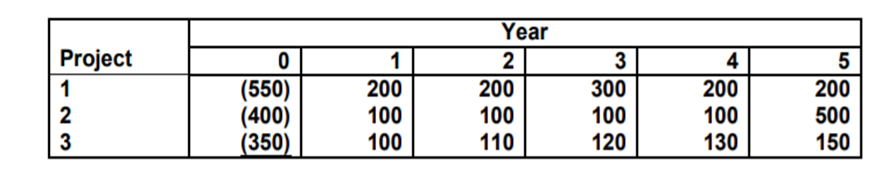

- Specific topics covered will include time value of money, the role of the financial markets in company financing, the nature and role of financial instruments, sources of financial information, evaluation of proposed capital expenditure, and cost of capital and the returns to providers of finance.

- This is an introduction to the fundamental concepts of business finance. The students will be exposed to the time value of money concept, the assets evaluation, the capital budgeting, the capital structure, and the cost of capital, and working capital management.

COURSE LEARNING OUTCOME

At the end of the course the students will be able to:

- Discuss the principles of finance and the roles of financial market that underline the finance discipline.(C2, PLO1)

- Demonstrate the concept of time value of money and various decision making techniques in financial planning. (C3,PLO8)

- Calculate the value of bonds and stock in a market place (C3,PLO8)

SUPPORT AND CONTACT DETAILS

- Name: Mimi Suriaty Binti Haji Abdul Rani

- Email : msuriaty@nilai.edu.my

- Consultation Hours: Wednesday (08:00 am – 10:00 am) and Thursday (08:00 am – 10:00 am